By Olev Edur

The past several years have certainly been a topsy-turvy time for Canada’s housing market, but most experts say that the situation should normalize later in 2024 or in 2025. There is, however, some debate as to just when–and to what extent–this will occur.

“Canada’s real-estate market has been on a roller coaster ride for the past four years,” Phil Soper, president and CEO of Royal LePage in North York, Ont., said earlier this year, when the company’s fourth-quarter Canadian House Price Survey results were released. (See Table 1, page 27, for a summary of these results.) “The global pandemic briefly brought mar- ket activity to a grinding halt in early 2020, which was followed by a rapid, widespread spike in demand and price appreciation as Canadians sought safe- ty and greater living space in their homes among a world of uncertainty.” And indeed, prices for some rural and recreational properties more than doubled during 2020 and 2021, while urban properties were a bit slower off the mark.

“By the spring of 2022, home prices had reached unprecedented highs, but when interest rates started rising quickly and steeply to combat infla- tion, an extended market correction began,” Soper said, noting that despite early gains, that year ended with the median home price nationwide having slipped 2.8 per cent—in marked contrast to the double-digit annual growth of the preceding two years.

Prices began to climb again in early 2023 but fell back in the second half as a result of continuing interest-rate increases. The net result was that in most cities other than Calgary, price increases during 2023 were modest single digits, although smaller cities such as St. John’s, N.L., Quebec City, and Kingston, Ont., performed better than the traditional growth leaders—the big cities. Overall, median prices were 7.9 per cent below the peak reached in the first quarter of 2022, but they were still well above pre-pandemic levels.

Looking Ahead

By the end of 2023, the consumer price index (CPI) annualized increase had been brought down to almost 3.1 per cent. If energy prices had been excluded, the rate would have been even lower—close to the Bank of Canada’s target rate of two per cent. Soper believes that with inflation largely tamed, we should begin to see rate reductions later this year—if they haven’t already begun by the time you read this article. That may help spur renewed demand and hence price growth.

“We see a move towards typical home-sale transaction levels in 2024 and, as the year progresses, appreciating house prices,” Soper predicted. “Looking ahead, we see 2024 as an important tipping point for the national economy as the majority of Canadians acknow- ledge that the ultra-low interest-rate era is dead and gone. We believe that the ‘great adjustment’ to tolerable, mid-sin- gle-digit borrowing costs will have a firm grip on our collective consciousness after only modest rate cuts by the Bank of Canada.”

Royal LePage’s forecast is therefore based on the prediction that the Bank of Canada will have concluded its campaign of interest-rate hikes and that the key lending rate will hold steady at five per cent through the first half of 2024 and start coming down modestly in late summer or fall. Soper pointed out that by January 2024, several major financial institutions had already begun to discount their fixed-mortgage rates.

Supply and Demand

Meanwhile, the housing supply remains constrained. “The number of homes available remains well below what we need today and will continue to need in the future,” Soper said. “The fundamental shortage of housing supply in this country will inevitably put upward pressure on home prices, when temporarily sidelined buyers return to the market in the months ahead.”

Indeed, according to the Canada Mortgage and Housing Corporation (CMHC), Canada needs about 3.5 million additional housing units by 2030 to restore affordability, with the greatest need concentrated in Ontario and British Columbia. And while the federal and provincial governments have collectively committed billions of dollars towards spurring new home construction, it’s assumed that inventory will remain out of step with projected demand for years to come.

“I see little hope that housing construction will meet that need this decade,” Soper said. “The demand/supply imbalance will put further upward pressure on home prices. The Bank of Canada governing council will soon face the difficult task of trying to balance the lowering of interest rates without simultaneously stimulating spending, which would cause inflation to rise again.”

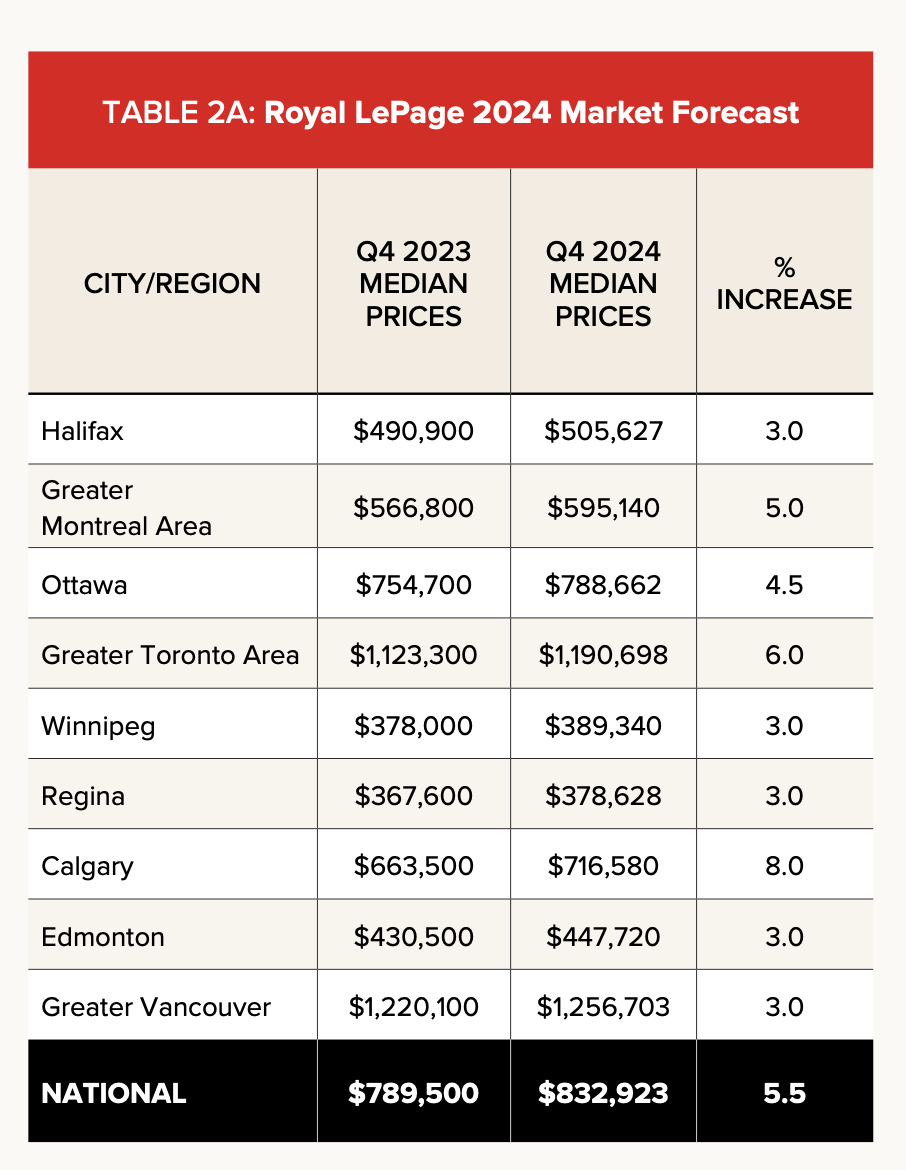

As a result, Royal LePage predicts that by the fourth quarter of 2024, the national aggregate price of a home will be 5.5 per cent above the fourth quarter of 2023—in other words, prices will have climbed back to the peak reached in the first quarter of 2022. (See Table 2a for the outlook in a few selected cities.)

Median Versus Average Prices

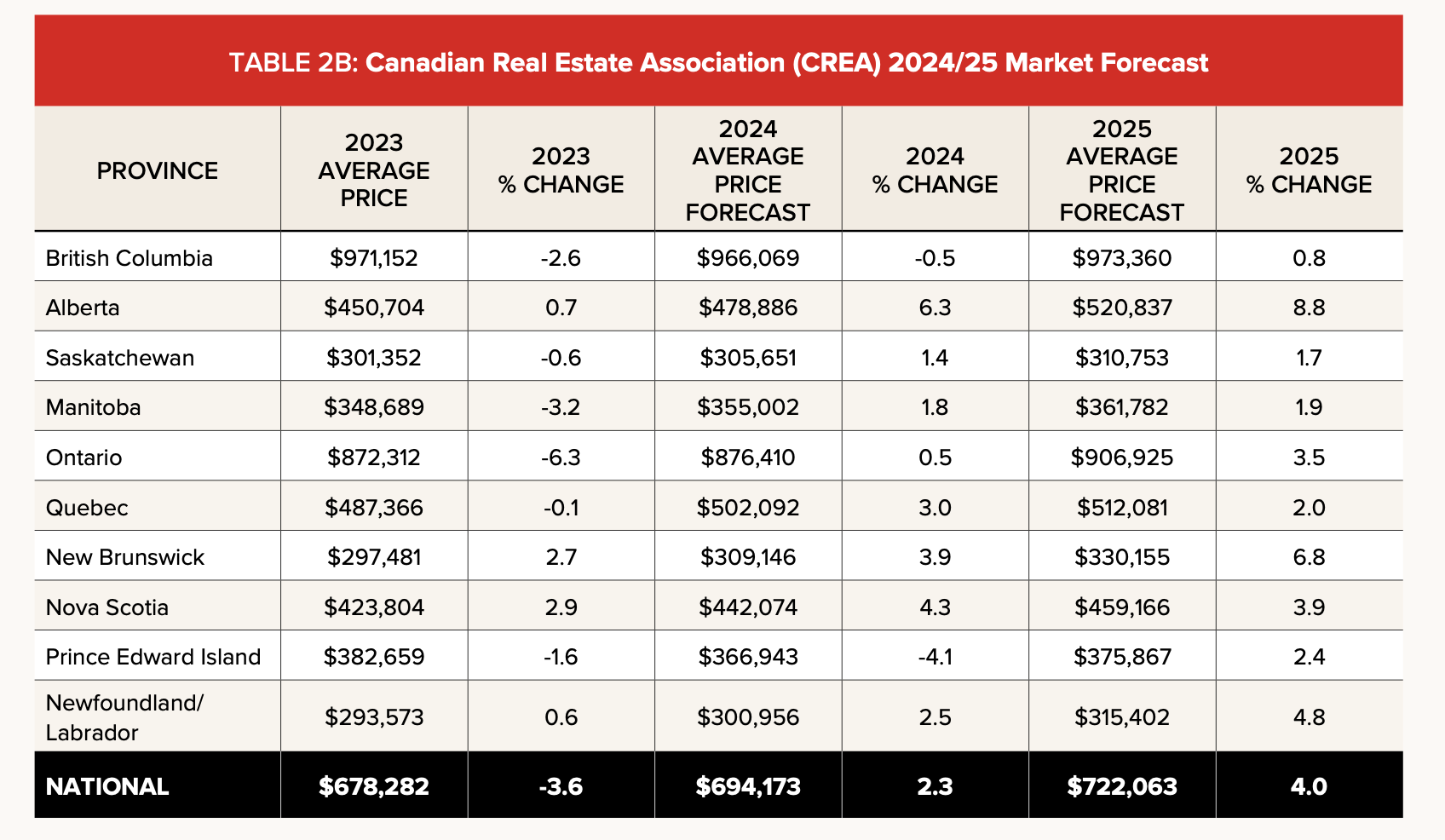

The Canadian Real Estate Association (CREA) seems to have a much more guarded view, however, and predicts that by year-end 2024, the average Canadian house price will have climbed just 2.3 per cent above the year-end 2023 level. And as Table 2b shows, the CREA predicts that prices will continue to shrink in British Columbia and Prince Edward Island this year and increase only minimally in several other provinces, though prices in Quebec, New Brunswick, Nova Scotia, and especially Alberta will see more robust growth.

Tables 2a and 2b differ in several respects, so apart from the overall growth picture, you can’t really com- pare the two. Royal LePage’s figures are oriented to larger cities, where prices and growth rates tend to be higher than in the rural areas and small towns included in the CREA’s figures. And Royal LePage looks at the percentage change in median prices between the fourth quarters of two consecutive years, whereas the CREA figures reflect changes in average prices during a given year. (A median figure represents the point at which half of sales are above and half are below that amount; average figures represent the total value of all sales divided by the number of sales. So if 10 properties sell for $400,000 and 20 properties sell for $600,000, the median price will be $600,000, but the aver- age price will be $533,333 ($400,000 x 10 + $600,000 x 20, divided by 30).

Elephants in the Room

A number of factors could render the CREA’s projections more realistic than Royal LePage’s. First, there’s no guar- antee that the Bank of Canada will indeed start lowering interest rates soon; in February, inflation ticked up- ward again, deferring the prospect of rate cuts. And even if the Bank does start lowering rates, increases in house prices could offset any benefit for would-be buyers while forestalling further rate cuts. That raises the question of how many homebuyers will want or be able to afford to jump into the market if the costs end up staying high.

This concern has resulted in the outlook at Re/Max Canada being even more muted than at the CREA. In a late-2023 article in the Toronto Star by Brennan Doherty, company president Christopher Alexander pointed out that interest-rate reductions may not make houses more affordable: “Mortgages are expensive. Affordability has really been the name of the game, and buyers have really [elected] to stay on the sidelines until their monthly carrying costs go down.”

Nevertheless, home sales did pick up again in late February and March, auguring price increases sooner rather than later. It remains to be seen whether this will further forestall any interest-rate cuts.

It also remains to be seen how much impact the federal govern- ment’s promised reductions in immigration and promised provincial as well as federal boosts in home construction will help moderate prices.

The CREA forecast cites CMHC figures indicating that in 2024 and 2025, nearly half (45 per cent) of all outstanding mortgages in the country, representing about 2.2 million house- holds, will be up for renewal, most of them at much higher rates. Given that many homeowners are already stretched as a result of high inflation over the past two years, the prospect of defaults looms large, and if the numbers are significant, this will put further downward pressure on prices as foreclosed properties are released back into the market.

The bottom line for retirees look- ing for the “right” time to sell the family house and perhaps downsize to a smaller home or condo is that they will need to keep an eye on all of the foregoing factors as the year progresses. You should also keep a close eye on local market activity, both where you are now and where you would like to be. To repeat Soper’s admonishment: “2024 is an important tipping point”—and with so many plates in the air, it’s hard to predict exactly where they will all have landed by year-end 2024, or even 2025.