By Olev Edur

Whether the money you manage to save should go into an RRSP or a TFSA depends on your circumstances and your goals

With the coming a new year, it’s time to start thinking about retirement savings and, more specifically, how best to make use of your registered plans to bolster those savings. After all, “RRSP season” (during which you can still make contributions for 2024) starts on January 1, 2025, and runs for the next 60 days. There’s also the tax-free savings account (TFSA) alternative to consider, although there’s no TFSA season—these tax-assisted savings vehicles operate on a calendar-year basis, with December 31 being the cut-off date for annual contributions. The introduction of TFSAs has added another complication to retirement planning: which of these plans is more appropriate for you and under what conditions? Should you use both?

“It’s important to understand that there’s no one-size-fits-all strategy when it comes to retirement saving,” says Pat Giles, vice-president of saving and investing at TD Bank in Toronto. “You have to understand what you are trying to do. The first question everyone should ask is ‘What are my goals?’ You also have to consider your tolerance for risk.”

This advice is echoed by Blair Evans, assistant vice-president of tax and estate planning at IG Wealth Management in Winnipeg: “The most important thing is that every RRSP and TFSA decision should be made in the context of your overall financial plan. What other assets do you own, and what are your needs? What’s your time horizon? The answers to these and other questions can make one option or the other more advantageous.”

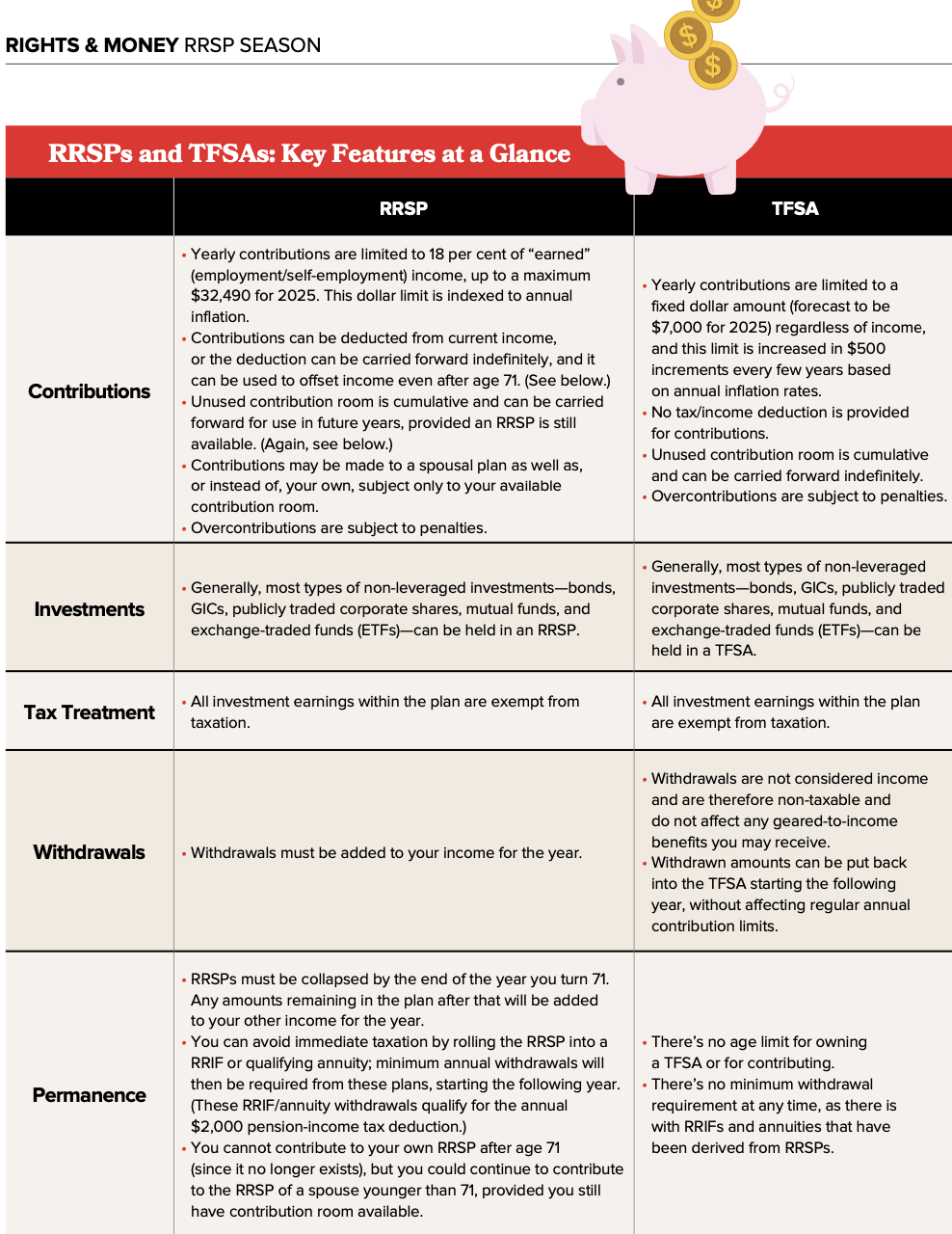

The box below describes the key features of both RRSPs and TFSAs. As you’ll see, there are some important similarities in these two types of plan—both have yearly limits on contributions, for example, and both allow for tax-sheltered investment growth within the plan. There are also some key differences, but the practical implications of these differences may not be apparent at first glance. Nevertheless, in many cases, one type of plan should be prioritized in retirement planning. In other cases, both plans offer advantages.

“RRSPs definitely make more sense if your income is higher when you’re making contributions and lower when you start withdrawing the money,” Giles says. “That’s because you’d get a higher tax deduction for your contributions and pay a lower rate of tax later.” Evans agrees and adds: “Another benefit of RRSPs is the ability to make contributions to a spousal plan—that’s particularly beneficial if the spouse is in a lower tax bracket.” TFSAs can still be useful, though, for those whose incomes are more than sufficient to make maximum RRSP contributions every year. After all, while TFSAs offer no tax breaks at the outset, you get the benefit of tax-free compounding and tax-free withdrawals. “It’s not always an either/or question,” Evans says. “Sometimes you can use both RRSPs and TFSAs.”

When TFSAs Are Better

There are situations in which TFSAs can make as much sense as RRSPs, or more sense. You get tax-free as opposed to tax-deferred growth, and there’s no age limit to owning and contributing to a TFSA. RRSPs have to be collapsed or rolled into a RRIF or an annuity by the year you turn 71, and minimum annual withdrawals are required thereafter. So, for example, if your retirement income might be higher in retirement than at present, TFSAs definitely offer advantages.

The calculation can be tricky—pressing immediate needs may prevail, and much depends on before-and-after income ratios. This is where professional advice can be particularly useful, although generally the TFSA option favours those whose pre-retirement incomes are fairly low. Nevertheless, in some cases, TFSAs have a clear advantage.

“If you’re likely to be receiving the Guaranteed Income Supplement (GIS) when you retire, that definitely makes TFSAs more attractive, because with an RRSP, all withdrawals must be included in your income, and that affects your benefits,” Evans says. “TFSA withdrawals, on the other hand, are not included in income and don’t affect your benefits. So in that situation, TFSAs are the better option.”

Every dollar you withdraw from an RRSP, is going to reduce your GIS entitlement by 50 cents. This penalty is severe enough that it may even be advisable for some people with small RRSPs—say, less than $50,000—to consider withdrawing all those funds in the next year or two, paying the attendant tax, and then putting the balance into a TFSA (if contribution room is available). That way, the remaining funds can continue to compound tax-free and will never again affect your GIS and possibly other entitlements.

Since TFSAs are never taxed and can be kept for life, they should generally be considered as a final resort when it comes to withdrawal strategies. That is, if, for example, you have an RRSP, some non-sheltered investments, and a TFSA, then in most cases you would want to first deplete the RRSP and non-sheltered savings, although, here again, some personalized professional advice would be in order.

TFSAs, RRSPs, and Investing

In discussing the investment strategies that would apply to these savings plans, Giles first cautions that they shouldn’t be mistaken for investments in themselves: “They are tax-assisted savings vehicles; they are containers for investments, not investments themselves.” This may seem confusing, because all the financial institutions offer their own proprietary “GIC RRSPs” or “mutual-fund RRSPs,” making it seem that the two products are one and the same. Technically (and legally) they’re not: this is just a way for financial institutions to simplify the buying/investing process for clients while also promoting sales of their in-house products.

In any event, whether you buy in-house or take a selfdirected approach (which allows you to choose any investments you want for your RRSP or TFSA), the same basic rules apply, albeit with a few tweaks. For example, if your investment portfolio comprises both fixed-income and equity investments, it’s generally best to keep the fixed-income components within a sheltered plan and the equity investments outside in order to maximize the benefit of lower tax on those investments. But again, you need to use these guidelines within the context of your overall financial plan. Don’t, for example, buy more fixed-income investments just because they can fit into your sheltered plans.

“The sooner you’re planning and saving, the better,” Evans says. “And you definitely should work with a professional in developing your overall plan. It will give you peace of mind, because he or she will know what works well and what options are available to you.”

Finally, review your financial plan regularly. “It’s not a one-time plan,” Evans says. “You will have to make adjustments to your plan as the years go by and your situation changes. Do you need to save more or have your income requirements changed? If you have additional needs, how do you accommodate them? At a minimum, you should review your plan every year or two and keep it up to date.”

This table shows some of the key features of RRSPs and TFSAs. As discussed in the accompanying article, there may be additional factors to consider, depending on the circumstances: special rules can apply to spousal rollovers when you pass on, for example, and contributions to a spousal RRSP will be attributed back to you and taxed in your hands, to the extent of any withdrawals from the plan made during the year of the contribution or the following two years. For this reason, professional guidance is always recommended for anyone contemplating the use of these tax-sheltered savings vehicles.