Rents have been declining for the past year in most Canadian cities, and it seems that they’ll continue to do so

By Olev Edur

After several years of dizzying rent increases (in lockstep with soaring house prices), it appears that government and industry efforts are finally starting to have a dampening effect on Canada’s rental markets.

Average rent costs declined in almost every area of the country during the past year or so, in some places quite substantially, and more decreases are likely forthcoming.

This will be good news for retirees who would like to avail themselves of rental accommodations. It may be that their kids have grown and they’ve sold the family home so that they can use the proceeds to more fully enjoy their retirement—that is, to pay for such things as travel, fine dining, entertainment, and hobbies. Others might want low-maintenance/low-cost accommodation nearer the kids, while some might simply want to live without the burden of a mortgage.

Whatever the impetus, soaring rental costs have been a strong deterrent. But the overall cost trend is definitely downward now—though we still have quite a way to go before we’re back in truly affordable rent territory. The declines aren’t spread evenly across the country, nor do they apply equally to all types of rental property. It therefore pays to investigate carefully if you’re planning a move to rental accommodation anywhere in Canada.

According to a recent Rentals.ca report, the overall average asking rent in Canada declined by 2.8 per cent (to $2,127) during the 12 months through April 2025—the seventh consecutive month of decreases, although that $2,127 figure was still 6.2 per cent higher than the average in 2023.

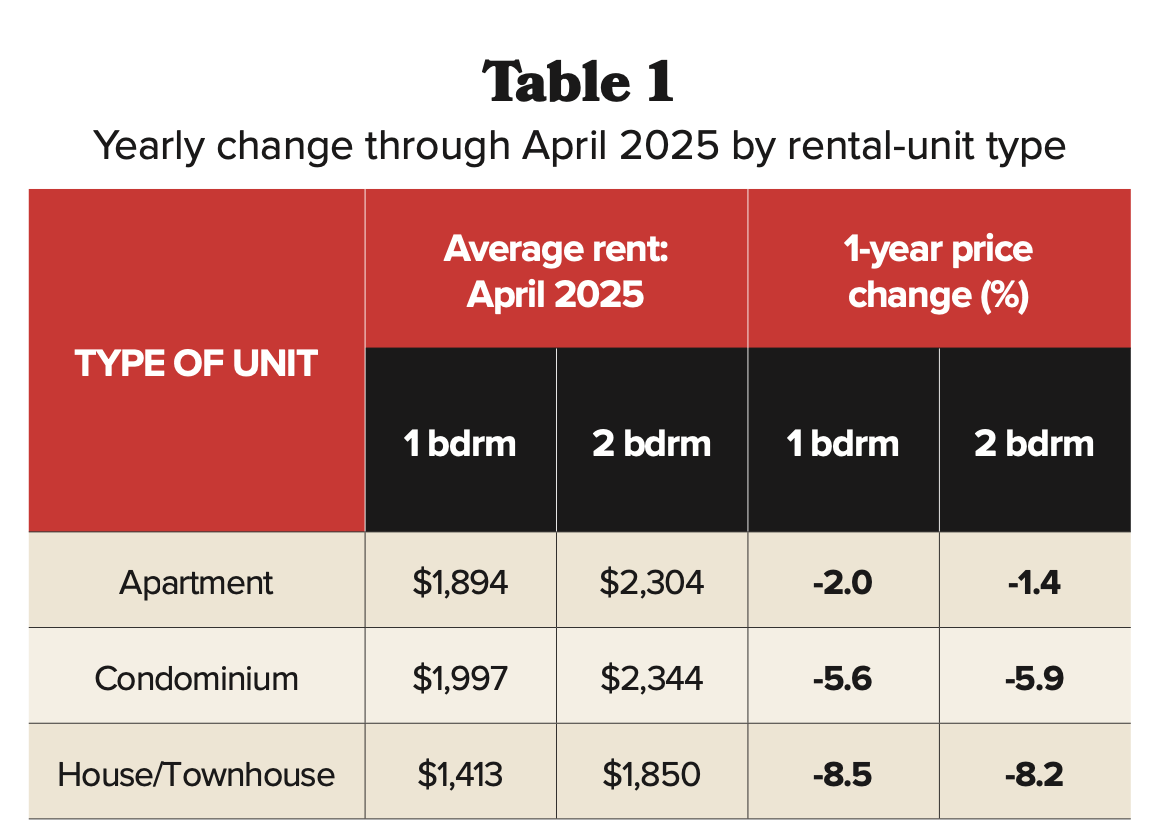

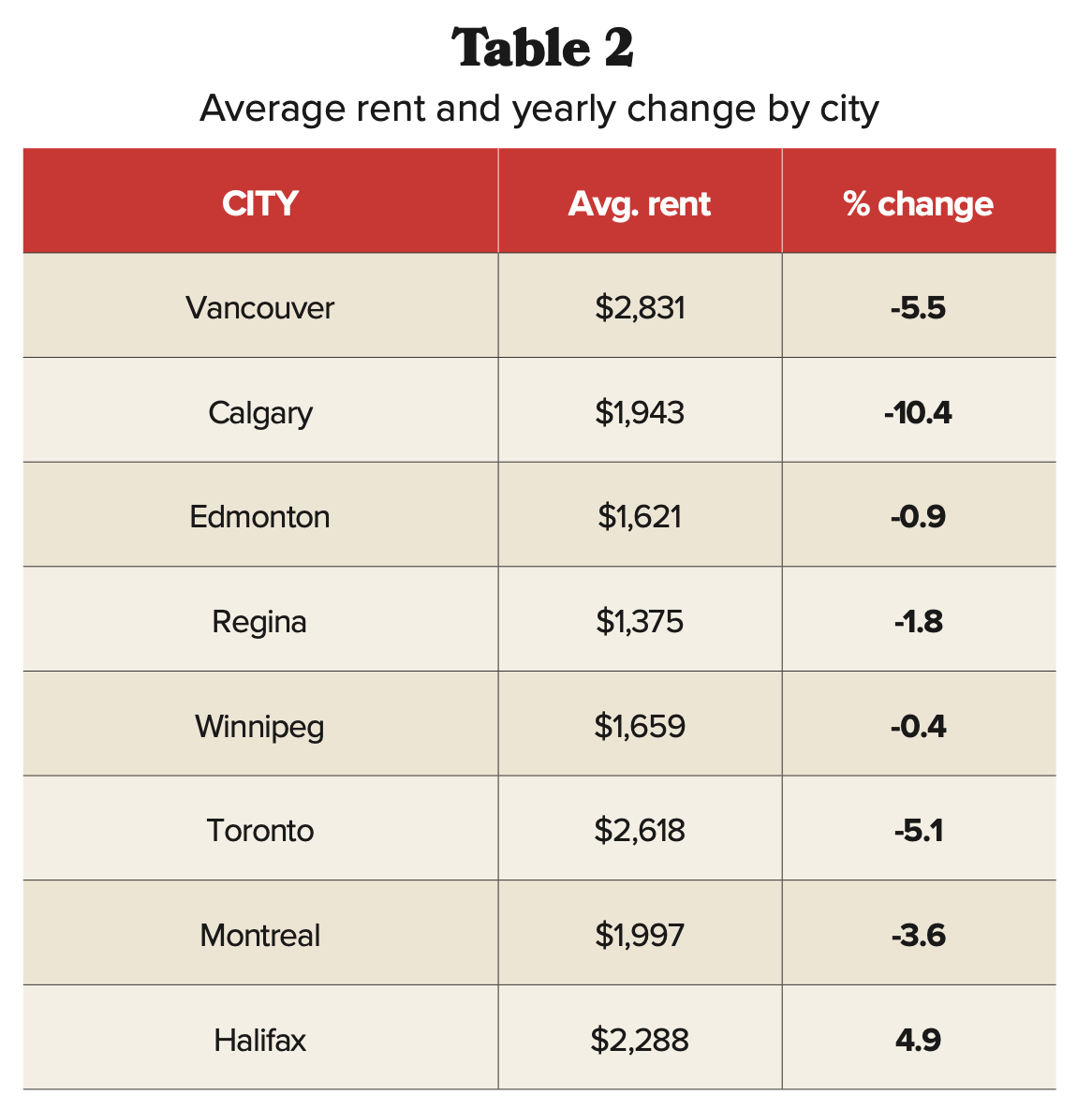

As Table 1 shows, though, the declines for the year through April were much greater for rental condos and houses than for purpose-built apartments. And as Table 2 shows, the declines were greatest in Calgary, Vancouver, and Toronto, while Halifax bucked the downward trend with a sizable 4.9 per cent average rent increase for the year.

This table shows the national average asking price of one- and two-bedroom rental units in April 2025, along with the change in price over the previous year. Source: Urbanation Inc., Rentals.ca Network data

A Cooling Trend

An earlier report entitled Canadian Rental Market Outlook, written by Rishi Sondhi at TD Economics in January 2025, found that rental prices had begun falling in 2024 and predicted that they would “continue cooling” through 2025. Given the underlying causes, which are ongoing, this cooling trend will likely continue well beyond 2025.

“Our outlook reflects a multitude of factors,” Sondhi states in his report. “Firstly, we’re expecting population growth to cool dramatically this year as the federal immigration plan is rolled out. We’ve already had a taste of this, with quarterly population growth [in the third quarter of 2024] easing to its slowest rate since 2021. In addition, another flood of rental supply will reach completion this year.”

A year-end 2024 housing market forecast from Canada Mortgage and Housing Corporation (CMHC) came to a similar conclusion: “We expect economic activity to be modest in 2025, picking up in 2026 and 2027…

Rental markets are expected to ease, with higher vacancy rates slowing rental [price] growth. Renter affordability will improve gradually, with more noticeable changes happening later in the forecast period.”

The Sondhi report cites falling interest rates during 2025 as a further factor that would help to foster improved rental affordability. But although the Bank of Canada, worried about the inflationary impact of US President Donald Trump’s tariffs, declined to lower interest rates in its April, June, or July rate announcements, Sondhi suggests that this lack of interest-rate relief may not change the rental outlook to any great extent.

“Canada’s economic future faces significant uncertainty due to potential changes in US trade policies and lower immigration levels,” the CMHC report says in summation. Similarly, Sondhi states that “a growth penalty from US tariffs was incorporated into this projection, but there is a growing risk that the impact could be more pronounced than we expected in our most recent economic forecast.”

In other words, the outlook gets hazy as a result of US trade policies and, specifically, Trump’s tariff wars. But the net result of a heightened tariff-driven economic slowdown, according to Sondhi, could be an even more subdued rental market: “Such a scenario would mark the weakest rent growth since the early 1990s, at least.”

And so, while it may seem perverse to view an economic slowdown as beneficial because it further lowers rental costs, such a silver lining could well be the unintended outcome if the increased tariffs announced by Trump this summer, and corresponding retaliations by the Canadian government, shape the economy as we move towards 2026 and beyond.

This table shows the overall average April 2025 asking rent prices in select cities, along with the year-over-year change in price. Source: Urbanation Inc., Rentals.ca Network data