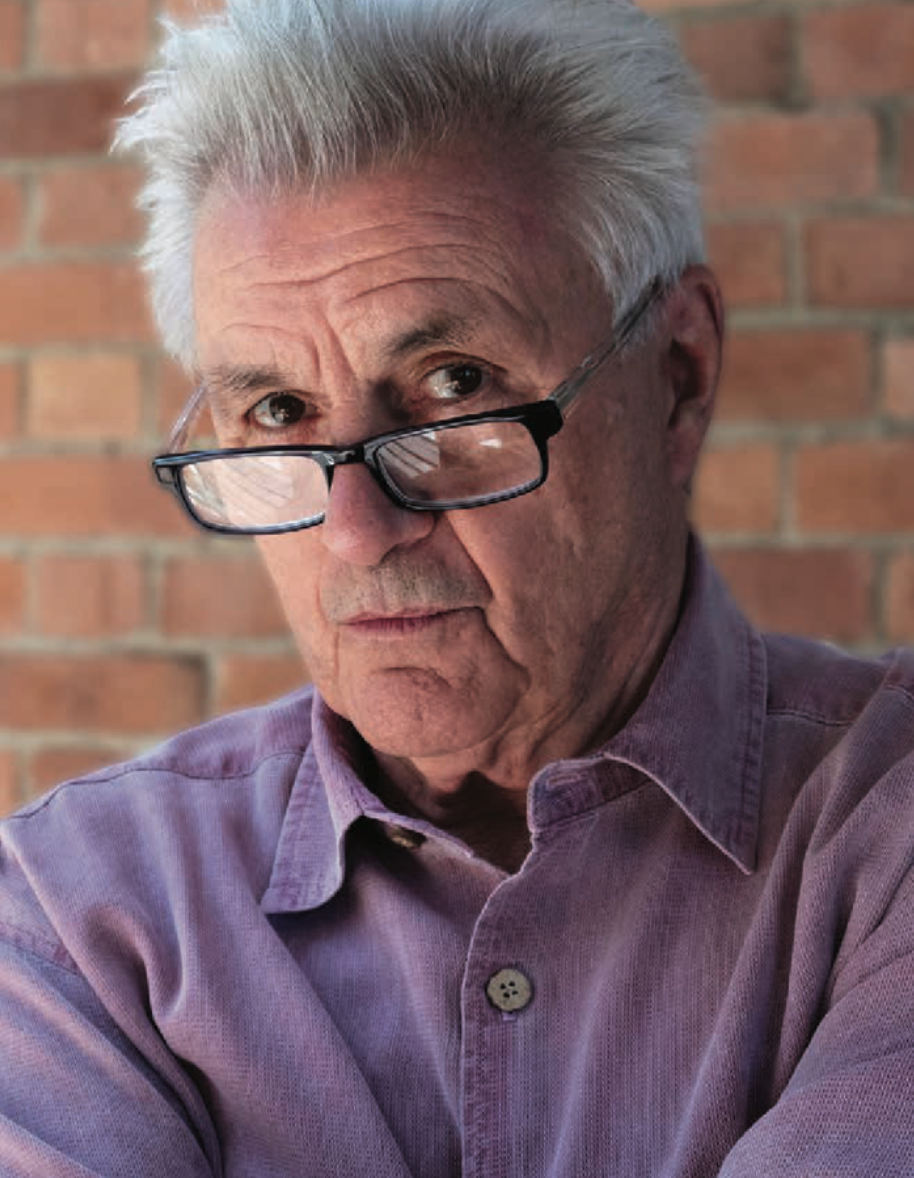

By Olev Edur

The right kind of policy can help with estate planning and even be a valuable investment

With the kids all grown and on their own, the mortgage paid off, and enough savings to provide your spouse with a comfortable retirement should you pass on unexpectedly, you really no longer have any need for life insurance, right? Wrong.

Life insurance is indeed normally viewed as a way to protect and provide funding for your growing family should an accident befall you. However, life insurance can also be invaluable when it comes to protecting your estate, although the type of insurance you need to buy for this purpose will likely be different from what is normally bought earlier in life. In most cases, people will buy term insurance to protect their growing families because of the lower cost, planner with Sun Life in Guelph, Ont., points out that this type of insurance is inappropriate when it comes to protecting one’s estate.

“Once you have sufficient assets so that you no longer need income replacement, you may not need this insurance any longer,” he says. “As your life evolves, so should your life insurance coverage. You want to be sure that when it comes to your estate, your investment in life insurance is going to pay off, so you need some form of permanent insurance. It’s more costly than term insurance, but it can be used to cover final expenses, such as funeral costs and estate tax liabilities. And it can be used to ensure that your estate assets can be kept intact for your kids.”

Mitchell Singer, director of taxation and estate planning at RBC Insurance in Toronto, concurs: “When you’re young, you’re typically dealing with term insurance—if something happens, you’ll be paid, regardless of when you pass on, as long as you pay the premiums. But term insurance has age limits, so in this situation, permanent insurance is much more appropriate.”

Three Types of Permanent Life

What is “permanent” insurance? Although there are many variations with differing features, there are really only three basic categories:

Term-to-100. Although the name implies that this, too, is a term insurance product, the term can actually continue indefinitely. You need to pay the premiums until age 100; after that, you no longer need to pay, but the insurance will remain in force until it’s needed.

“Term-to-100 is the simplest permanent life insurance product,” Giles says. “You pay level premiums that never change [as opposed to periodically escalating premiums for term insurance], and the payout when you pass on is guaranteed, regardless of age or health.” Unlike the other two forms of permanent insurance, though, term-to-100 is “non-participating”—it has no built-in investment component that can grow over time and add to the payout; you get the guaranteed amount and that’s it.

Participating whole life (“parlife”). With this type of insurance, the premiums and payout are generally fixed and guaranteed, but there’s also a participation/investment component that grows over time on a tax-deferred basis.

These policies acquire a cash surrender value prior to the death of the insured, and there may be a deferred tax liability if redeemed prematurely, although upon death the payout is fully tax-free. “This is the oldest form of permanent insurance in the country; it dates back 150 years,” Giles says.

“There’s an investment component, although there’s no investment flexibility—the investment money goes into a pooled fund, and the insurer manages the pool.” Investment returns are allocated to individual policies in the form of “dividends” (not to be mistaken for the dividends that may be paid to shareholders of corporations). The amounts depend on the investment experience of the pool, mortality rates (deaths as well as policy cancellations), and administrative costs.

Universal life. Universal life is a participating policy in that it has an investment component, but the investment component is maintained separately from the insurance component, even though it is accorded the same tax treatment as with par life; in addition, rather than the insurer man- aging the money pool, you can choose how this additional money is invested in your own policy. You can diversify the holdings, just as you can with a self-directed RRSP or tax-free savings account (TFSA), and employ asset allocation to accommodate your risk tolerance and investment objectives. In other words, it can be designed to meet your particular needs.

“With universal life, you have a lot more flexibility when it comes to the investment component,” Singer says. “A minimum premium is required to fund the insurance, but beyond that, you can increase the premium stream. You can even pay the premiums from the investment funds and choose how this is done.”

The Magic of Insurance Growth

The key to the advantage of life insurance when it comes to estate planning—or indeed for protecting young families—lies in its tax treatment. There are very few financial products that can provide tax-free compounding as well as tax-free payouts. An RRSP, for example, will allow for tax-free compounding, but in the end, all the money that comes out of the RRSP is fully taxed, including all the growth that took place within the plan.

“Life insurance provides tax-free growth and a tax-free payout—this isn’t talked about enough,” Giles says. “In Canada, there are only four sources of truly tax-free income: principal residences, TFSAs, lottery winnings, and life insurance proceeds.”

Furthermore, the added magic of participating policies (including universal life) lies in the fact that you can double down on this tax-free advantage by “overpaying” for the insurance in order to fund that investment component. “Overfunding is a good way to create wealth that grows un- taxed,” Giles says. “This can make a huge difference to your estate.”

There are, however, legislated limits to how much you can overpay. Generally, these are set in relation to the amount of the insurance value, although different policies may have their own limits on the amount and timing of contributions. “Every participating life policy is different in terms of how it is structured to allow payments into the investment component,” Singer says. “But the more you can put in early on, the longer it can grow tax-free.”

“You have to look at the numbers,” Giles says. “You have to calculate the difference between putting your money into an insurance policy that provides tax-free growth and a tax-free payout and putting your money into investments where the growth is going to be taxed. If the difference is going to be only one or two per cent, then maybe it isn’t worth it, but if it’s going to make a five or 10 per cent difference, then, yes, it’s definitely going to be worthwhile.”

A Variety of Applications

As for exactly where the proceeds of an insurance policy can best be used to benefit one’s estate, there are numerous situations, some more common than others. “In estate planning, people often have a need for liquidity—particularly useful where there is a single large asset such as a cottage or second building that will attract tax when you pass it on,” Singer says.

“The tax-free payout from a life insurance policy can ensure that there will be no strings attached in the form of taxes or any other liabilities.”

Similarly, when there are large assets and liabilities and more than one child is involved, life insurance can be used to help equalize the bequests to each child. “Whether it’s to pay taxes on a cottage or to provide equal treatment to siblings if one child is supposed to inherit a certain asset, life insurance is one of the few products that can fulfill this need,” Singer says. “If, for example, you plan to have one child take over the family business, you can give the others cash so that everyone is treated fairly. And kids often choose to pay for insurance on their parents so that the mortgage on the cottage can be paid off.”

Giles agrees that this is a fairly common practice: “We had one client whose parents owned an apartment building, and the kids used the cash flow it generated to take out a joint- and-last-to-die policy on their parents so that the capital gains tax on the apartment building could be covered with the insurance payout.”

In another case, he says, “a couple had defined-benefit pension plans that covered all their day-to-day expenses and enabled them to live comfortably, and they also had RRSPs worth about $500,000 and TFSAs worth $800,000. They didn’t like the volatility of the stock market, so we did the calculations, and after all the taxes were paid, their estate would have been left with about $1.2 million in net wealth. If they bought life insurance instead, their net wealth increased by almost another million dollars— that’s a huge difference.”

In yet another case, a client owned a business that had a corporate investment account that was never used, and he wanted to pass it on to the kids. “He redirected a multi-year cash flow through a corporate asset transfer to fund a joint-and-last-to-die policy, and the net result was that the insurance added $400,000 to the estate’s net worth,” Giles says.

Understanding the Fine Print

Both Giles and Singer stress that permanent life insurance policies are complex, specialized contracts with many variations and features, so it’s important to ensure that you understand exactly what a policy does and doesn’t do before you sign on. And that will require the advice of a skilled professional. “Permanent life insurance can be complicated, so you definitely need expert advice,” Singer says. “It’s important to choose insurance with the help of a good adviser.”

“It’s hard to provide any kind of hypothetical pricing guidelines because there are so many variables involved,” Giles says. “It can depend on the amount of coverage, age and health, and the type of policy and its overpayment or investment provisions. What you buy depends on your situation and what coverage you really need, and everyone’s situation is different, so you need to consult with a qualified adviser who can take a holistic approach to your unique financial situation.”