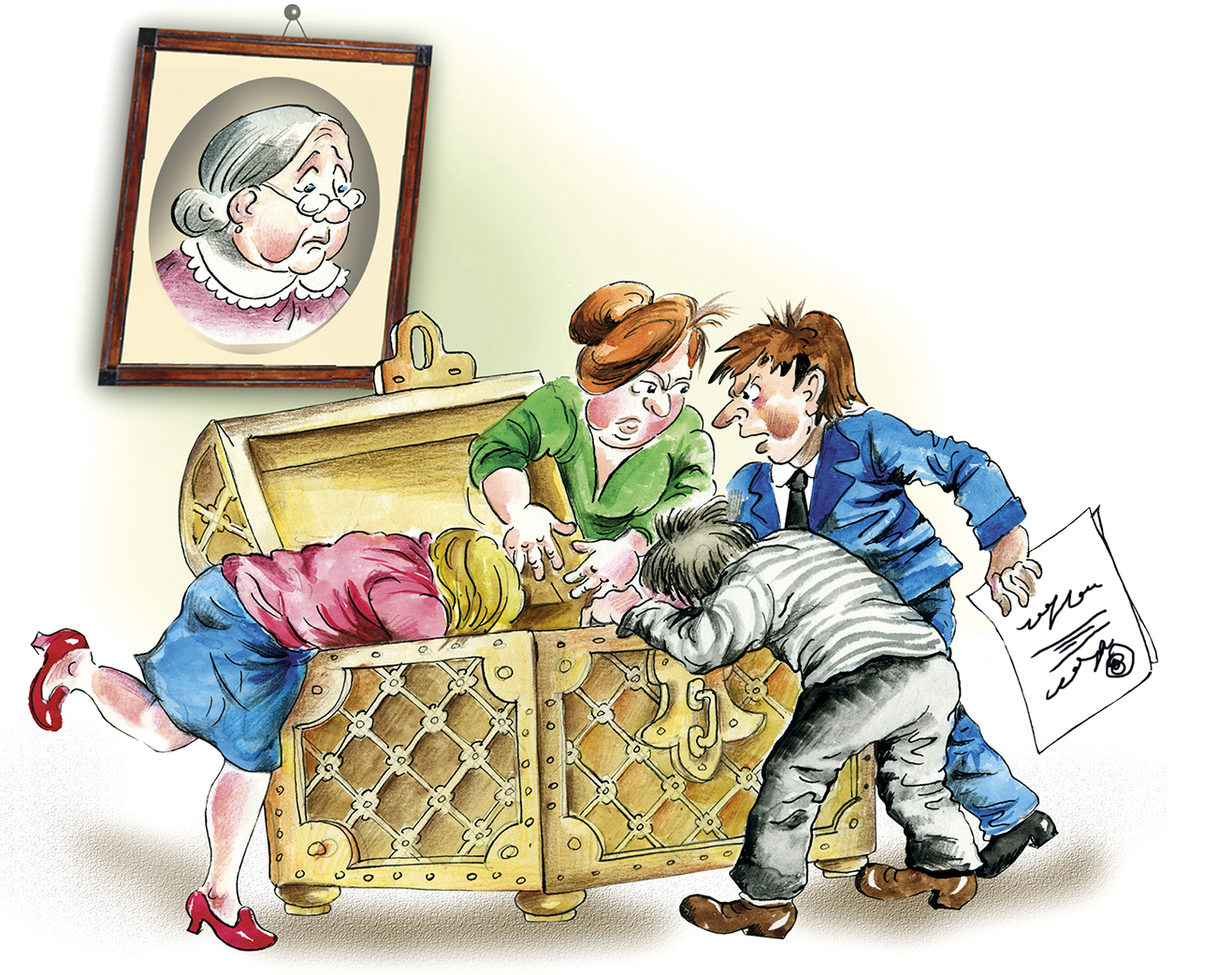

Poor estate planning can tear a family apart

By Les Kotzer and Olev Edur

Planning your estate and creating a will can be complicated undertakings, especially when you have children and perhaps other loved ones or charities that you want to benefit.

In addition to all the thought and effort that has to go into ensuring that you’re maximizing the value of your bequests by minimizing taxes and other costs, you have to see to it that everyone is treated equitably. In a situation in which interests can be in conflict, you must take pains to ensure that you don’t create rifts and hard feelings among all concerned.

A poorly planned estate, or one that isn’t planned at all, can tear a family apart and create undying resentment and bitterness. To avoid this fate, wills lawyer Les Kotzer, of Fish & Associates in Thornhill, ON, provides the following tips for avoiding family inheritance feuds.

1. Remember that communication is vital.

Silence is not golden when it comes to wills and inheritances. Not talking to your children about these important issues and keeping your head in the sand is dangerous and can lead to disputes after you pass away. It’s important to let your children know how to reach your lawyer, your accountant, and your financial advisor. Where can your children find your will and your power of attorney? Does anybody owe you money or do you owe anybody money? What are your wishes regarding funerals or cremation? If you don’t tell them, your children will have to guess.

You also should discuss whether one or more of your children want to serve as your executor or power of attorney or not, so that they don’t simply find out upon your incapacity or death. One of your children may not want to do it; if you’ve appointed him or her and he or she rejects the appointment, the others may look at him or her as a traitor to the family.

2. Take care with executor appointments.

If you appoint only one child as executor, your other kids may harbour feelings of jealousy because they weren’t appointed and may make the chosen one’s life a misery. In particular, beware of appointing a child likely to end up becoming a “dictator” executor. As sole executor, for example, he or she will have the power to sell your cottage and divide the proceeds rather than keeping the cottage in the family. All the others may want to keep the cottage, but the executor doesn’t have to listen to them, may not care about the cottage, and may sell it to a third party. The same could apply to your cherished family home. Your executor doesn’t have to ask the other children whether to sell. He or she has the power as executor to whatever he or she chooses.

You also must understand that if you appoint two executors, they have to act together. Can they get along and work together, or will every discussion about your estate be a battle? Similarly, if you appoint three children as executors and don’t have a majority clause put in your will, it means all decisions will have to be unanimous. Can all executors agree or will there be deadlocks?

3. Review your beneficiary designations.

You may have named one child as your beneficiary on your RRSP or life insurance, thinking that child would share the proceeds with the other kids when you pass away. But when you die and he or she gets these proceeds, he or she doesn’t have to share them with the other children. Being named as a beneficiary means you own the money and have no legal obligation to share.

Sometimes it’s wise to appoint your estate as the beneficiary on an asset such as life insurance, despite the probate implications, so that you know there will be money to pay your debts and funeral expenses. If you name a child, he or she can use it for himself or herself and not use the money to pay debts or funeral expenses. This can cause real family tension after you pass away, so make sure to review your designations on an ongoing basis.

4. Think fairness rather than equality.

It’s foolish to think that leaving everything in your will equally to all your kids will automatically prevent them from fighting after you die. Stamping an equal sign on your will can lead to more fighting, especially if, for example, you have a caregiving child who has given up a great deal of his or her life to help you while the others have not helped, or if you have at some point already given a large sum of money to one child in your lifetime.

Is it really fair to give the caregiving child the same as children who rarely see you? Is it fair that the child who received a large sum of money during your lifetime gets to keep that money as well as sharing evenly in the rest of your estate? Not thinking this through can lead to acrimony and bitterness among your children.

At the same time, beware the 90/10 rule mistake—leaving one child the bulk of your estate and another child a small percentage. By giving one, say, 10 per cent, you’ve given him or her an entry into the estate, and he or she can make the 90 per cent beneficiary’s life miserable by questioning everything he or she does. A better solution is to leave a fixed payout amount rather than a percentage of the estate itself, so that once paid, he or she is out of the equation.

5. Be cautious about sharing real estate.

Leaving real estate equally to all your children means they become co-owners, but can they work together or will they be constantly battling over management of the property? Will their spouses interfere? It may be better to leave one building to one child and another building to another child so that they aren’t co-owners. If the buildings don’t have the same value, or if there’s only one property, a monetary gift can compensate for the difference.

6. Think about the allocation of personal effects.

When it comes to special items such as Mom’s wedding ring or the treasured painting over the fireplace, try to create a neutral solution for who gets what. You can’t split a painting on the wall or a table in the hall, so one solution would be to have the kids flip a coin or draw straws for any potential causes of conflict. Similarly, if one child bought you a valuable personal item, don’t leave it to another child; leave it to the child who gave it to you. Leaving it up to the kids to decide could create terrible battles.

7. Remember that second marriages create special considerations.

If you’re in a second marriage or relationship with children from a previous marriage, consider leaving everything to your new spouse and asking that when you both die, your estate be divided among all of the children.

Remember that after you pass away and your new spouse or partner has inherited all of your assets, he or she can make a new will and cut out the children from your first marriage. Planning based on trust may leave those children with nothing. Spouses in second marriages should consider seeing separate lawyers to protect their unique interests.

8. Be wary of homemade wills.

A homemade will can have many dangers. First, is it valid? Does it comply with the formalities required by law? Does it use words that have multiple interpretations? For example, “my gold ring” could mean the 14k ring or the 10k ring. Does the will designate backup executors and backup beneficiaries? If your son isn’t alive when you die, does his share go to his own children or does it go to your other children? Homemade wills are often a recipe for a family battle, and parents who use them are often planting the seeds of destruction for their own family.

9. Make sure to review and update often.

If your will leaves your son the house on Nightingale Street, but you move to Hummingbird Street and don’t update your will, your son won’t get the new house. In addition, asset values can change over time; it’s important to review your will and the value of your assets regularly to avoid the inequality you’re trying to avoid and to make sure that everyone continues to get what you intend them to get.

Photo: iStock/shibanuk.