If you’re working from home during the pandemic, you may be able to claim a deduction when you file your taxes next year

By Erika Morris

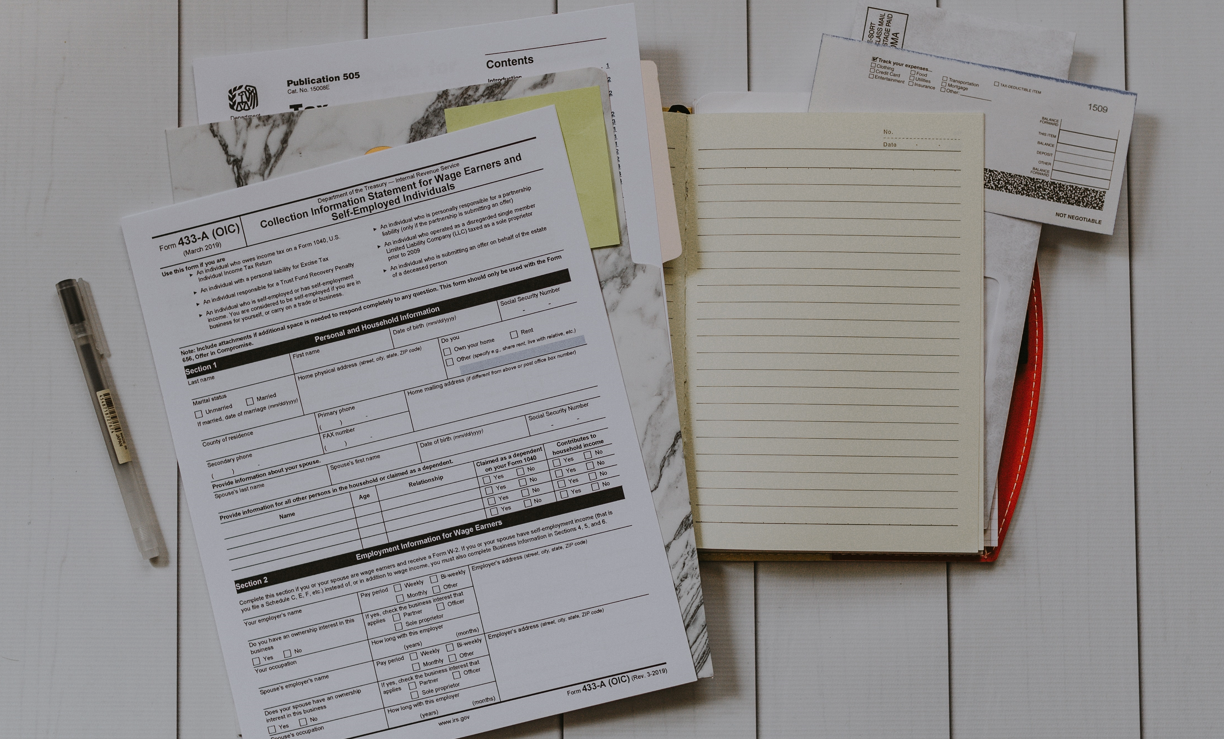

Those who are self-employed know that they can claim a deduction at tax time for certain expenses, but—under the right conditions—employees who have shifted to working from home may also be able to claim a deduction.

Employers are meant to supply everything necessary for work, such as computers and office equipment, but expenses you incur for which your employer doesn’t reimburse you might be allowable.

As to whether you can make a claim, there are two conditions. You’ll have to have worked from home for six months, and your home office has to be your main place of work—that is, you work there at least 50% of your working hours.

How much you can claim is based on how much of your home is used as a workspace—if it’s one room out of six, the deduction will be less that if you work all day in one of three rooms in a condo. Eligible expenses can include electricity, gas, property taxes, and repair costs. Items such as paper, pens, or laptops you buy that are not reimbursed by the employer can also be deducted. Internet, phone bills, and rent don’t always qualify.

Those who intend to make a claim must have their employer complete the Canada Revenue Agency’s form T2200, Declaration of Conditions of Employment, confirming that the employer isn’t covering the costs claimed in the deduction. It’s important to keep all receipts because tax auditors can do home inspections and evaluate your workspace.

Photo: iStock/fizkes.